INDEPENDENT ADVICE

If it’s not exclusively in your best interest, it’s not the best advice.

By creating an independent practice, we were able to take the best of what was out there and provide it to clients with a fiduciary commitment to their needs.

Over the years, we’ve built up an in-house team of experienced professionals, while integrating unique technology tools and developing proven investment models – our clients see the benefits of these resources within a completely open and transparent environment.

PERSONALIZED INVESTMENT PLANS

Best of Both Worlds

Robo-advisors often do quite well – until the market turns. The fact remains that it takes skill and experience to adapt to changing market conditions, much like those in our current environment.

In order to create your personalized investment plan, we combine the computing power of our unique analytical software with the expertise of our highly experienced and accredited in-house team.

Your personal investment plan involves:

- Defining your risk tolerance, investment objectives and time parameters

- Identifying strategies to minimize tax while meeting your liquidity needs

- Adhering to a strict monitoring, management and reporting process

- Determining the appropriate location and allocation of your assets

- Combining traditional money management with our proven investment models, in order to meet your objectives for preservation and growth

- Providing an Investment Policy Statement summarizing your investment strategy

PLANNING RESOURCES

Investing is what we do.

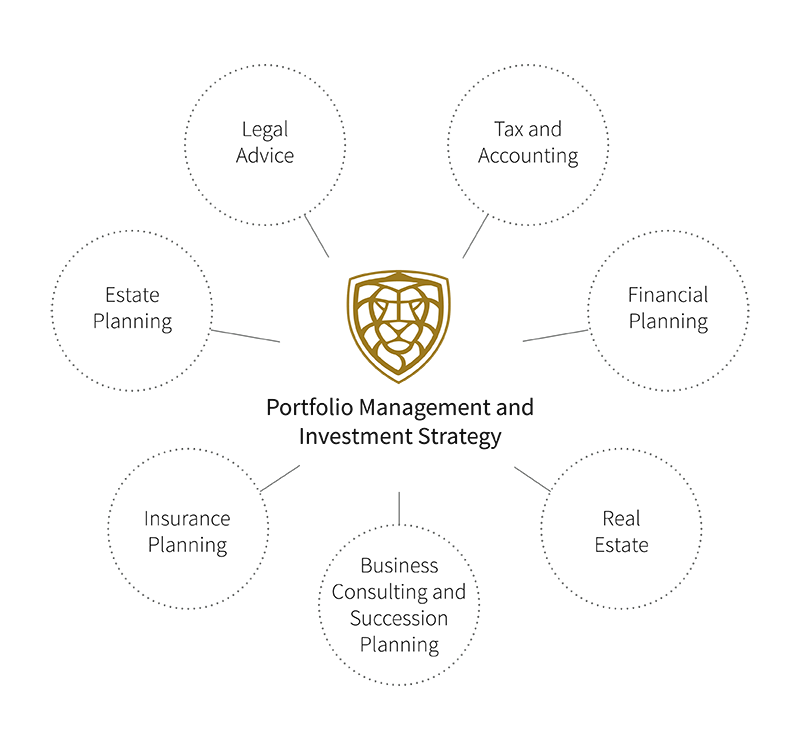

But we also have a network of service professionals to whom we are happy to refer you, to help ensure your investment strategies are in line with your other wealth strategies, including:

As part of premium service for clients over $500,000 in investable assets, we also include a full retirement plan as part of the strategy development process.

TAX EFFICIENCY

Is your wealth growing tax-efficiently?

When you review your investments, you’re not just thinking about your next statement or benchmark, you’re thinking about your next life event, your retirement, or the succession of your business.

In order to balance these priorities, it’s essential to find the appropriate balance of taxable and nontaxable allocations. We work with you to identify the best way to minimize tax while improving your savings for retirement and other goals, through IPPs, RRSPs, TFSAs and other structures.

The Security of Your Assets

Clients of Harris-Bolduc & Associates benefit from the support of National Bank Independent Network (NBIN), which is in turn backed by the financial strength and stability of National Bank of Canada, one of the country’s oldest and most reliable financial institutions.

NBIN provides the custodial and administrative services that help us to operate on an independent platform, while ensuring our clients’ information and assets are completely secure. NBIN is regulated by the Investment Industry Regulatory Organization of Canada.